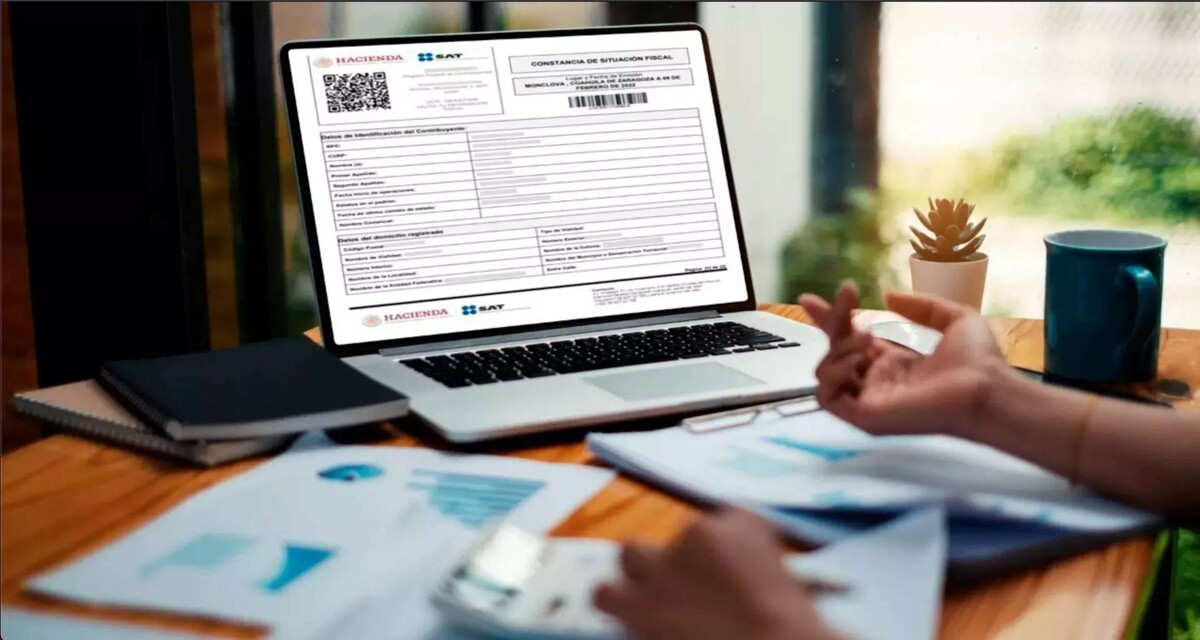

The Fiscal Situation Certificate (CSF) is an essential document for carrying out various procedures in Mexico. This document verifies the tax regime and economic activities of an individual or legal entity. The CSF has multiple uses, such as verifying your tax regime and economic activity, meeting employment contracting requirements, presenting formalities for legal, tax, and commercial procedures, identifying yourself to government authorities, requesting loans or opening bank accounts, and participating in tenders and commercial contracts.

To obtain your Fiscal Situation Certificate, it is necessary to have your Federal Taxpayer Registry (RFC) and the password for your SAT account. You can generate your certificate online by accessing the SAT portal, selecting the option 'Generate your Fiscal Situation Certificate', and logging in with your information. Once inside, you can download the document in PDF format.

The CSF issued by the Tax Administration Service (SAT) is fundamental to keep you up to date with your tax obligations and avoid setbacks in official procedures. It is like the DNA of the taxpayer and is a requirement for carrying out procedures such as issuing invoices, employment contracting, or opening bank accounts. Remember that obtaining your Fiscal Situation Certificate is easy, quick, and free, and you can do it from anywhere with an internet connection.