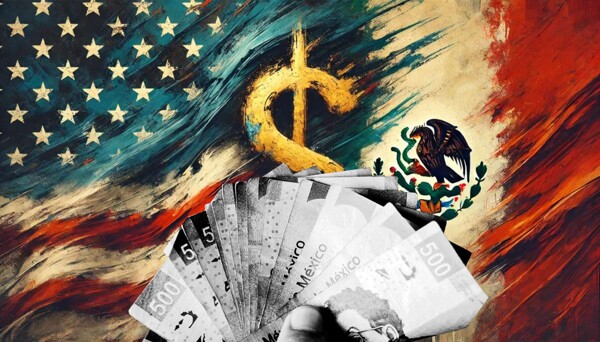

The Mexican peso is recovering from the tariffs imposed by Donald Trump and is getting close to 20 units per dollar. Claudia Sheinbaum, the president, will present measures from the 'Plan B' in response to this situation, criticizing the tariffs and rejecting accusations from the White House regarding alleged alliances between cartels and the Mexican government.

In statements, Sheinbaum stated that the 'Plan B' will include both tariff and non-tariff measures in response to Trump's unilateral decision to tax Mexican exports. Furthermore, she vehemently rejected the White House's accusations and asserted that, if any alliances exist, they are in the arms of the United States.

Sheinbaum is expected to talk with Trump about the tariffs in a phone call. Trump, for his part, has mentioned that he hopes to impose the tariffs and believes that Mexico owes him a lot of money and that they will eventually pay.

After a depreciation the previous day, the Mexican peso has trimmed losses and is trading around 21.04 units per dollar. It is expected that Sheinbaum and Trump will reach an agreement to prevent the tariffs from coming into effect next Tuesday.

Economic analysts have warned that if the tariffs are applied, the exchange rate could reach 23 units. Other forecasts suggest potential negative effects such as a decline in GDP and volatility in the exchange rate. However, there is a possibility that, if an agreement is reached, the peso may appreciate to 19.5 units.

The trade 'war' started by Trump has affected emerging markets, as reflected in the depreciation of the Mexican peso and the decline of other international assets. Investors are leaning towards a stronger dollar due to the tariffs, which could impact inflation and limit rate cuts globally.