The market shows optimism about Mexico following the recognition of U.S. Secretary of Commerce Howard Lutnick towards the "analytical" response of the Mexican government to the tariffs imposed by Donald Trump. The Mexican peso appreciates and positions itself as the second strongest currency among emerging market currencies, reflecting analysts' expectations that Mexico will reach a trade agreement with the U.S.

In the face of the tariff war, some countries have responded similarly, while the Mayor of Mexico City, Claudia Sheinbaum, advocates waiting until April 2 to know Trump’s decision before acting. In this context, Sheinbaum emphasizes that in a tariff war, everyone suffers.

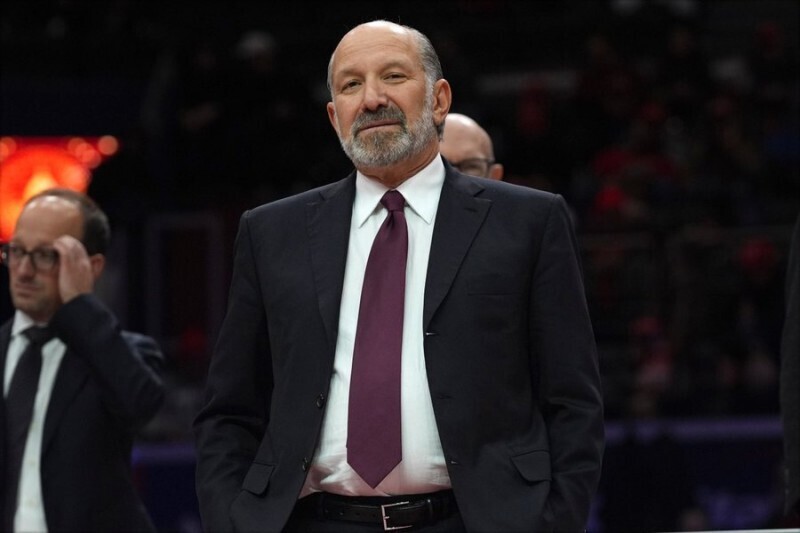

The Secretary of Economy, Marcelo Ebrard, is consulting with the steel and aluminum sector, affected by the tariffs, with the aim of evaluating measures in case Trump intensifies his actions against Mexico. Howard Lutnick, in an interview, pointed out that some countries are carefully studying how they will interact with the U.S., highlighting that the relationship will be better for those who choose cooperation over retaliation.

The firm Franklin Templeton dismisses that the USMCA is in danger and forecasts a resurgence of nearshoring in the coming years. At the close of the day, the exchange rate was 20.08 pesos per dollar, according to data from the Bank of Mexico (Banxico).