The state-owned oil company Pemex reports on new financial provisions, ignoring the plans of the head of government Claudia Sheinbaum to restructure the company. The current quarter became the third in a row for the company to post a net loss, in which fixed costs, write-offs of doubtful accounts, and partial investment were recorded.

In the first half of the year, Pemex posted a loss of 61.2 million pesos, which became the largest loss in its history due to the write-downs of assets to 161.5 million pesos. The previous quarter, the company had a loss of 59.5 million pesos, also excluding the current state. According to financial reports, the main reasons for the decline in production volumes were a decrease in the sale of refined products, a reduction in the list of financial assets, write-offs of derivatives, and an increase in taxes.

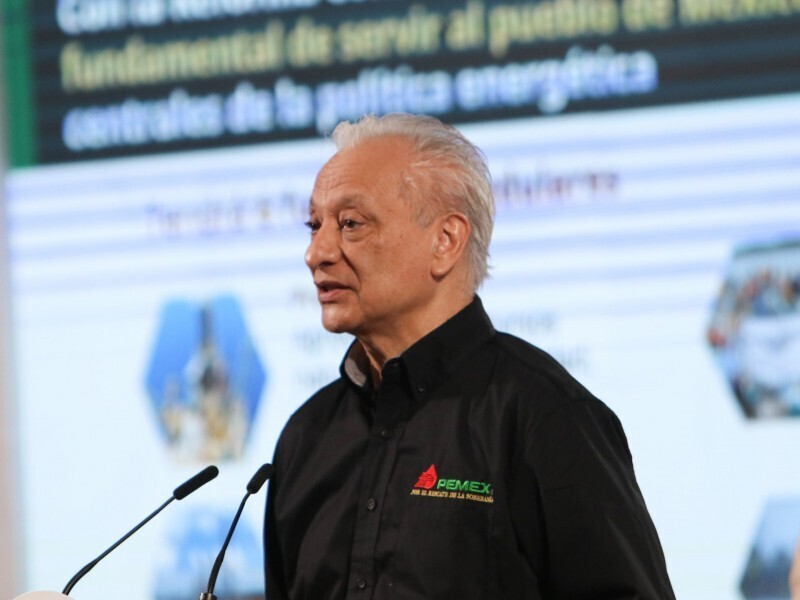

The company's long-term debt increased, reaching 100.3 billion dollars (1.843 trillion pesos) at the end of the second quarter. This is 1.5 billion dollars more, or 1.5% more, than the 98.8 billion dollars recorded in the first quarter. Earlier, the head of state, Victor Rodriguez, announced that the reduction in the Pemex debt to 85 billion dollars per year was a priority.

The government of Mexico continues to work on the program, which includes an active policy of state subsidies and the expansion of social spending. However, the results do not yet allow for the correction of the budget.