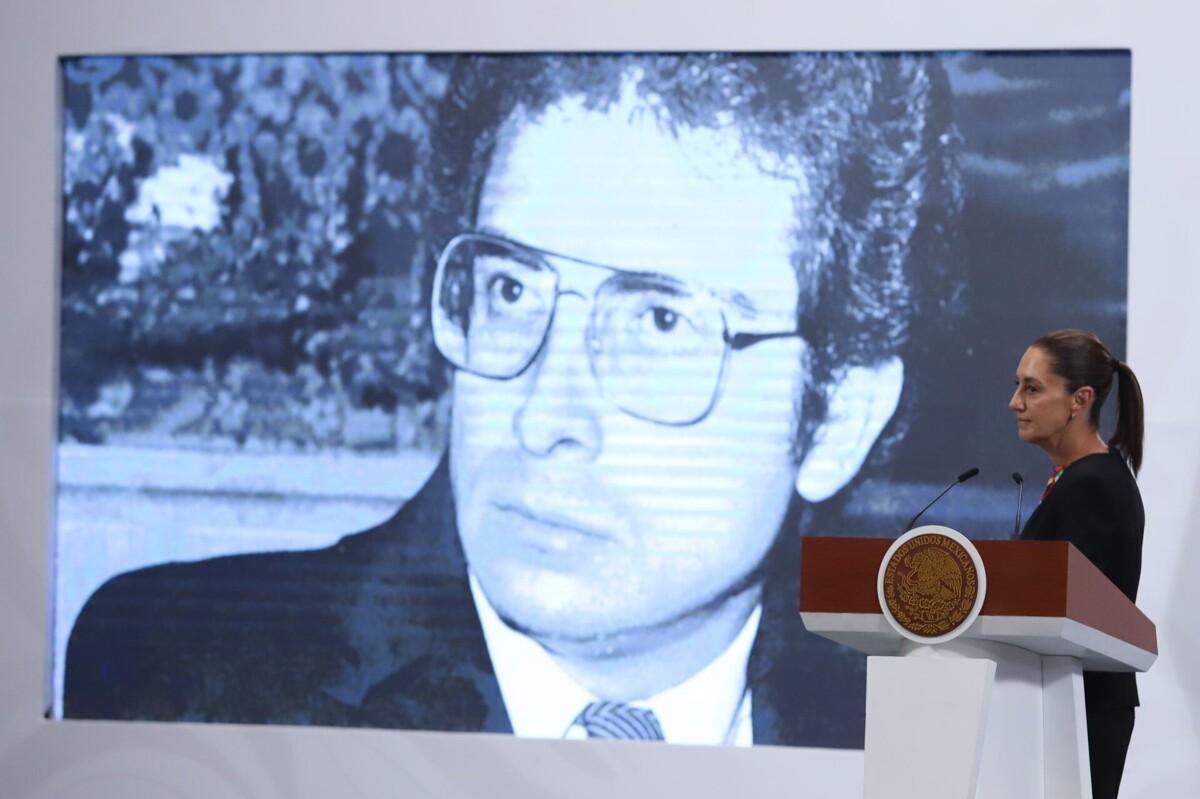

During Zedillo's six-year term, the Mexican financial system was saved by Fobaproa, which, in the former president's words, was a necessary action to rescue failing banks and protect the savings of the population. Zedillo implemented strict regulatory measures for banks, thus strengthening the Mexican banking system and avoiding the damages that the U.S. housing crisis caused in other international markets.

In the midst of an economic crisis, Mexico found it necessary to propose sources of payment to ensure compliance with its debts, opting for VAT as an easily collectible solution with less tax evasion. Despite his critics, Zedillo justifies the creation of Fobaproa as an essential tool in a moment of financial urgency, thus avoiding catastrophic consequences for the country.

The former president has been questioned about the cost and possible abuses of Fobaproa; however, he emphasizes that at the time, no other alternatives were foreseeable to face the financial crisis. Zedillo highlights the importance of actions like this in emergency situations, where the priority was to preserve the financial stability of the country and avoid a systemic collapse.

Despite the criticisms and questions, Zedillo defends his management and the decisions made in a crisis context. He emphasizes that, although controversial, these measures were essential to prevent a greater economic disaster. Finally, he acknowledges that there are gray areas in his mandate but underscores his commitment to democracy and the strengthening of institutions during his administration.