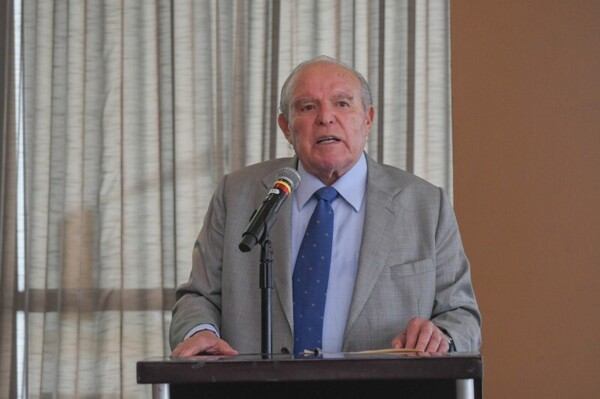

The progress of the inflationary landscape in the country will allow for further cuts to the reference rate for the remainder of the year, according to Victoria Rodríguez, governor of the Bank of Mexico (Banxico). During her participation in the Chapultepec Conference, organized by the Bank for International Settlements (BIS), Rodríguez stated that, despite the adjustments, the central bank's stance will remain restrictive. "We will remain attentive to the current challenges in the upcoming meetings and to the recalibration of monetary policy."

Following the announcement of a 50 basis point cut to the reference rate by Banxico, lowering it to 9.50 percent, the governor emphasized that "we could consider a similar magnitude downward adjustment" due to a less adverse environment regarding the inflationary episode in the country. However, she pointed out that there is uncertainty regarding the possible effects of the policies that the new U.S. administration may adopt.

Victoria Rodríguez warned about the risk that the world could face lower competition and productivity, as well as a lack of incentives for technology adoption, if the imposition of tariffs becomes more persistent in the future. The governor urged central banks to remain vigilant to the evolution of trade tensions and to adopt measures that ensure an orderly adjustment of prices and anchor long-term inflation expectations.

Regarding communication, Rodríguez highlighted that in Mexico, the disinflationary process has progressed positively and that Banxico will remain committed to the mandate of price stability, improving its communication tools. "Clear and coherent communication, along with a firm commitment and the transmission of that commitment to price stability, is essential to anchor inflation expectations," the governor concluded.