A negative outlook suggests the possibility of a downgrade within a period of 12 to 18 months. In contrast, S&P reaffirmed its rating and outlook at the end of the previous year, arguing the financial strength of the country following the political decision to reduce the public deficit this year, as well as the independence of the Bank of Mexico (Banxico). Fitch, for its part, also reaffirmed its rating and stable outlook in July 2024, just over a month after the elections, and has not made any changes since then.

The relevance of the investment grade is that there are many investment funds that require the bonds they acquire to have this rating, excluding those that lack that accreditation.

"It is evident that the judgments that rating agencies have today could change, especially if a horizon that transcends this year is anticipated. The key factor will be discipline in public finances. If a trajectory of the deficit is observed in accordance with what the Ministry of Finance indicated in the Economic Policy Criteria, I believe there will be no changes this year or in the first months of the next," said a specialist.

In less than two weeks, we will have the first report on public finances for this year, which will begin to outline some answers to these questions. A substantially lower economic growth than expected could influence the decisions of the rating agencies. "One of the most influential factors would be the imposition of tariffs by the United States, which could drastically slow down exports and consequently significantly reduce the expected level of GDP," explained the analyst.

Regarding the real risks of a credit downgrade, the behavior of public spending is observed, with a potential loss of control being a risk factor. Furthermore, the performance of Pemex will be meticulously evaluated by the rating agencies in the coming months, although a downgrade by one notch would not mean the loss of the investment grade.

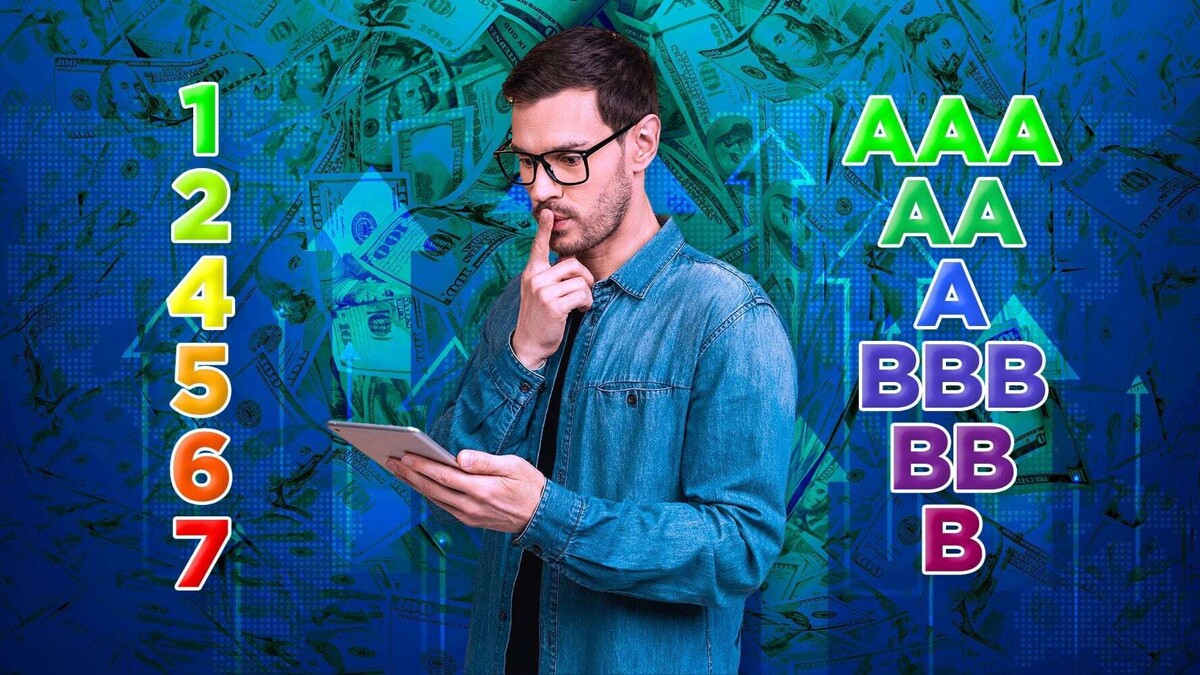

Moody's grants Mexico a rating of Baa2 with a negative outlook, while S&P rates the country BBB with a stable outlook, placing it two notches above investment grade. Fitch Ratings assigns a rating of BBB- with a stable outlook, positioning it only one level above the investment grade. Moody's changed the outlook for the Mexican rating from "stable" to "negative" in November of last year.