All credit cards issued in Mexico now operate under the new Universal Statement, a format that provides more detailed information about your spending, the lifespan of your debts, costs, and interest amounts when using small payments, and the savings you would have if you become a total client.

Juan Luis Ordaz, director of Financial Education at Citibanamex, explained that the new Universal Statement is an arrangement driven by the Bank of Mexico (Banxico) and the National Commission for the Protection and Defense of Users of Financial Services (Condusef), with the purpose of contributing to better financial decision-making.

The new statement is designed to improve transparency, facilitate the use and understanding of the functions, ways of use, and financial benefits of credit cards. This format will provide all the necessary information to make more informed financial decisions.

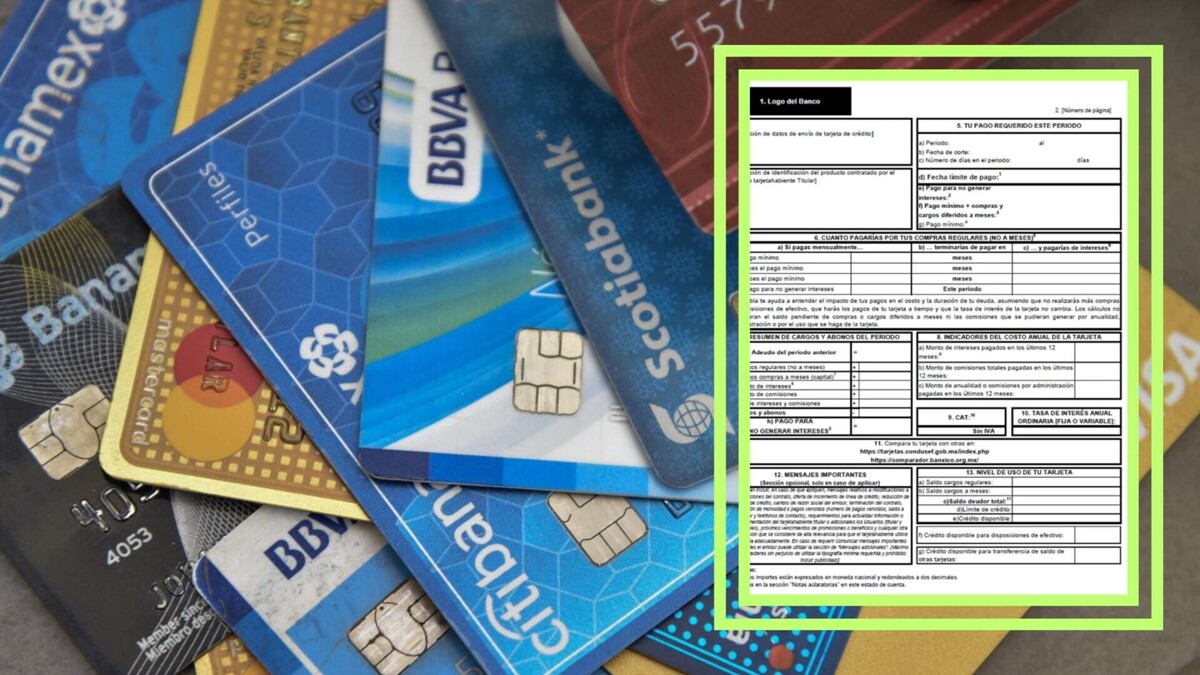

According to Juan Luis Ordaz, on the first page of the Universal Statement, you will find a summary of charges and credits for the period, indicators of costs covered in previous periods such as the Total Annual Cost (CAT) and the annual interest rate of your card, along with the level of card usage and available credits.

The new Universal Statement, which came into operation on October 1, 2024, consists of three main sections. The first page shows different scenarios of how much you would pay for your regular purchases if you cover different amounts, which will help to understand the impact of your payments on the cost and duration of your debt.

The subsequent pages of the Universal Statement contain information about other lines of credit, card benefits programs, balances, payment distribution, transactions, unrecognized charges, options for debt restructuring, and a glossary of terms and abbreviations.

The new format offers tools to make the best use of your credit card, allowing you to make more informed financial decisions.